UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ý

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

| NEW YORK MORTGAGE TRUST, INC. | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box):

ý | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

| 3) | Filing Party: |

| 4) | Date Filed: |

275 Madison Avenue

New York, New York 10016

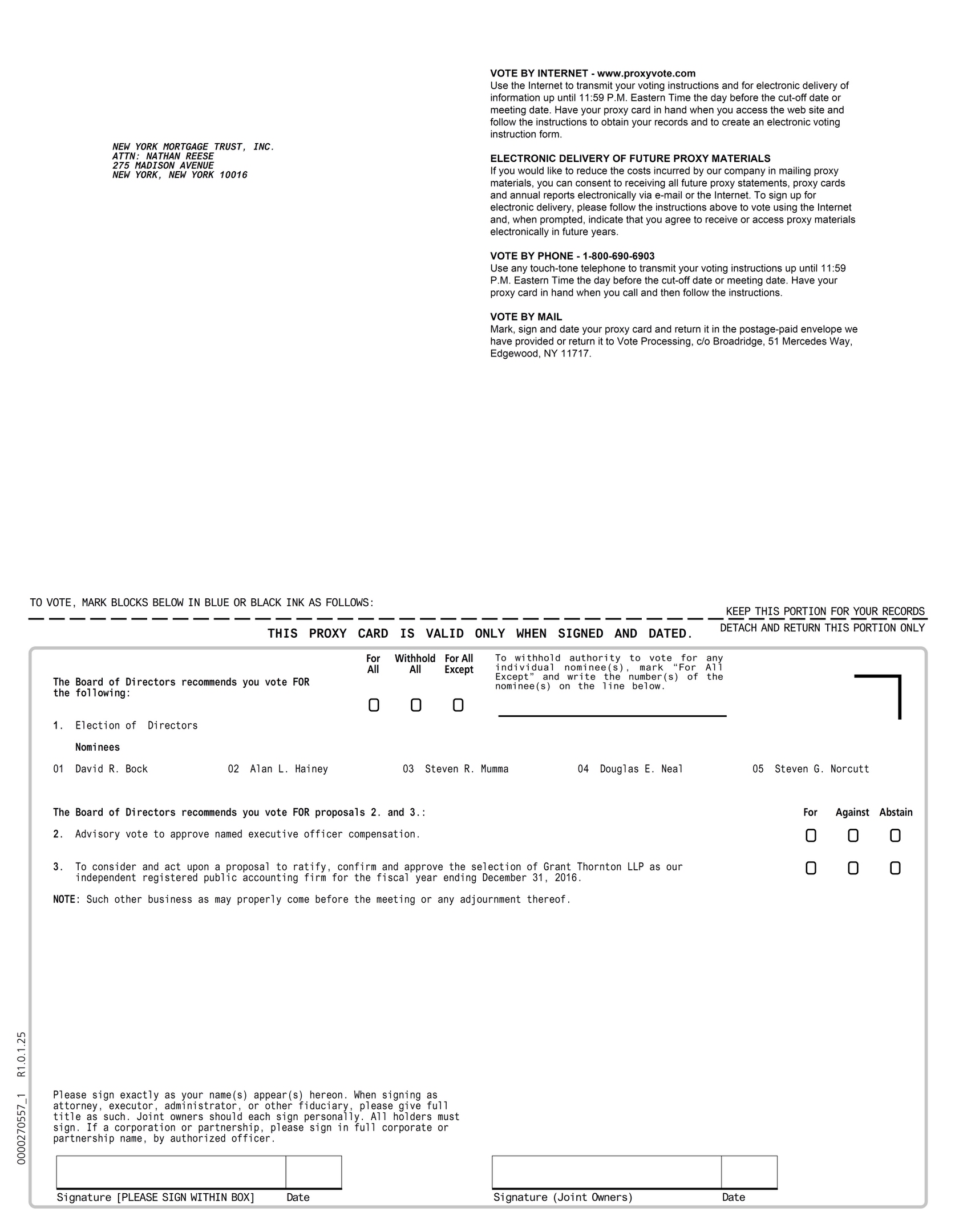

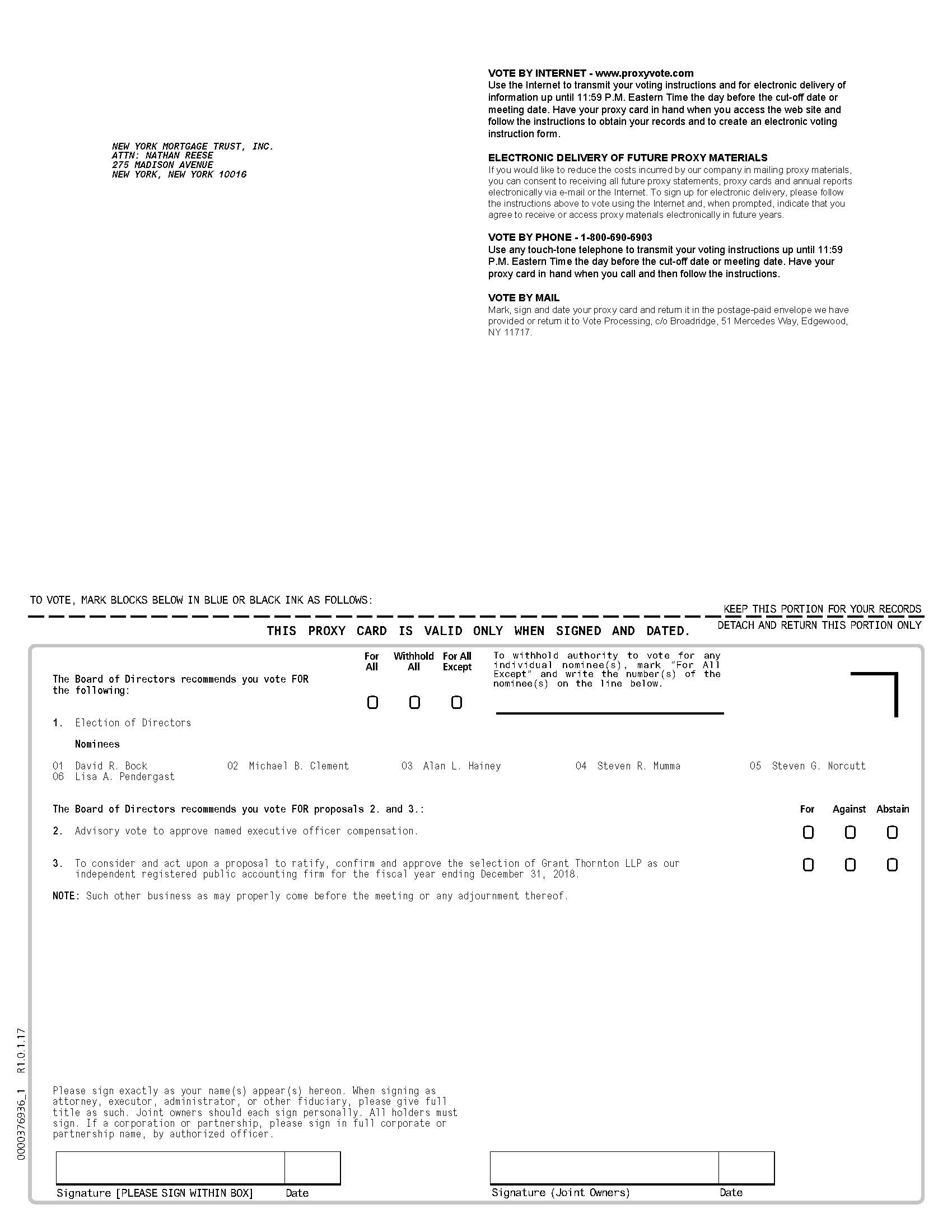

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 12, 2016 JUNE 4, 2018

To Our Stockholders:

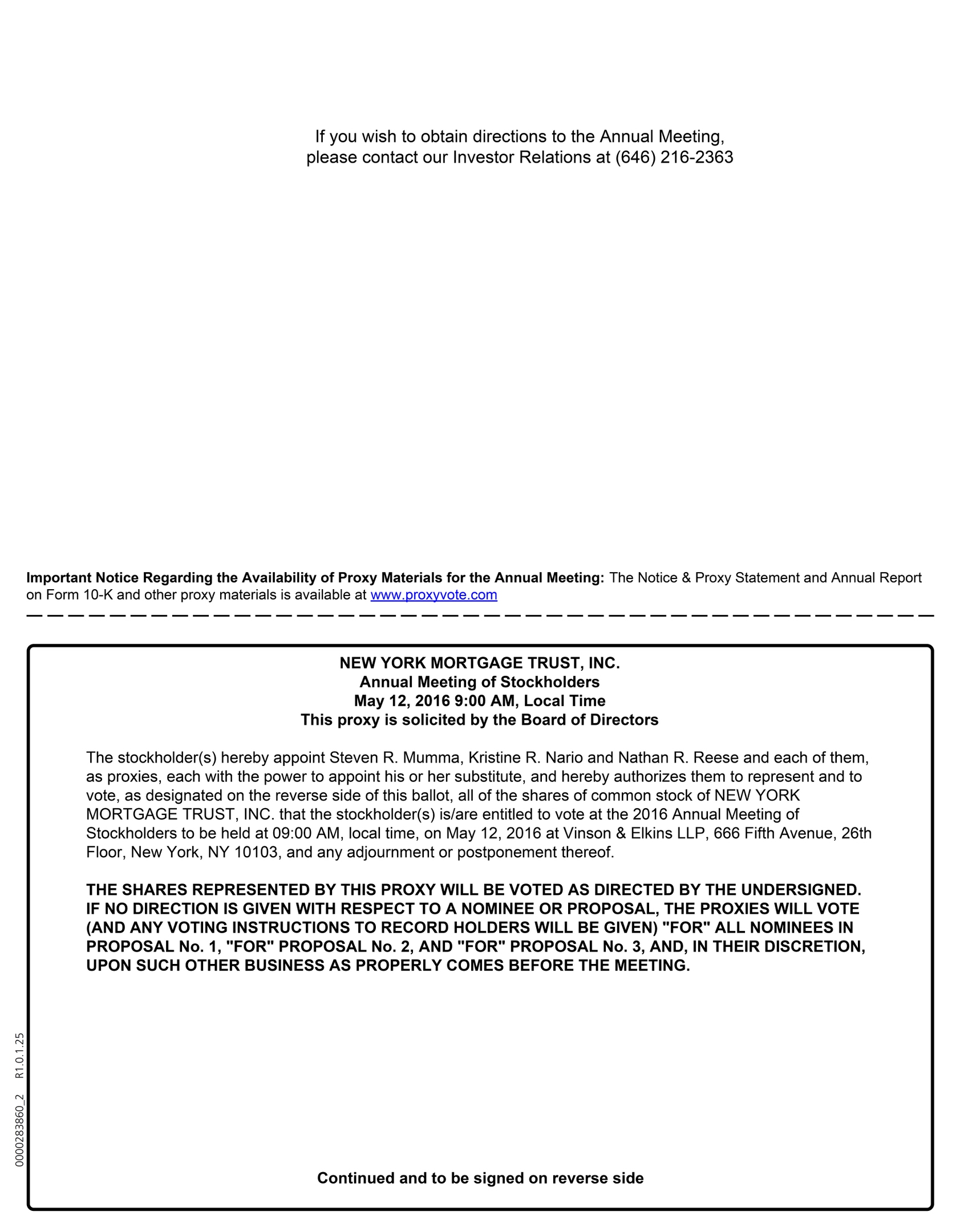

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of New York Mortgage Trust, Inc. (the “Company,” “we,” “our,” or “us”) on Thursday, May 12, 2016Monday, June 4, 2018 at 9:1:00 a.m.p.m., local time, at the offices of Vinson & Elkins LLP,L.L.P., 666 Fifth Avenue, 26th Floor, New York, New York 10103 to consider and take action on the following:

1. To elect the fivesix directors nominated and recommended by the Board of Directors of the Company (the "Board of Directors"), each to serve until the 20172019 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified;

2. To hold an advisory vote to approve named executive officer compensation; and

3. To consider and act upon a proposal to ratify, confirm, and approve the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2018.

In addition, stockholders will consider and vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The Board of Directors has set the close of business on March 17, 2016April 9, 2018 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting. Only stockholders of record on that date are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

We furnish our proxy materials to our stockholders over the Internet, as we believe that this “e-proxy” process expedites stockholder receipt of proxy materials while also lowering the cost and reducing the environmental impact of our Annual Meeting. In connection with this approach, on or about March 31, 2016,April 20, 2018, we mailed a Notice Regarding the Availability of Proxy Materials (the “Notice”) to holders of our common stock as of the close of business on March 17, 2016.April 9, 2018. Beginning on the date of the mailing of the Notice, all stockholders of record had the ability to access all of the proxy materials and the Company’s Annual Report on Form 10-K on a website referred to in the Notice and to complete and submit their proxy on the Internet, over the telephone or through the mail. These proxy materials are available free of charge. If you received a Notice by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice provides instructions on how you can request a paper copy of the proxy materials if you desire and each of the Notice and proxy materials provide instructions on how you can vote your proxy. Please see the attached proxy statement or Notice for more details on how you can vote.

If you wish to attend the Annual Meeting in person, you must register not later than 3:00 p.m., local time, on May 11, 2016June 1, 2018 by contacting Investor Relations by email at investorrelations@nymtrust.com or by phone at (646) 216-2363.216-2360. Attendance at the Annual Meeting will be limited to persons that register in advance and present proof of stock ownership on the record date and picture identification. If you hold shares directly in your name as the stockholder of record, proof of ownership could include a copy of your account statement or a copy of your stock certificate(s). If you hold shares through an intermediary, such as a broker, bank or other nominee, proof of stock ownership could include a proxy from your broker, bank or other nominee or a copy of your brokerage or bank account statement. Additionally, if you intend to vote your shares at the meetingAnnual Meeting and hold your shares through an intermediary, you must request a “legal proxy” from your broker, bank or other nominee and bring this legal proxy to the meeting.Annual Meeting.

The Board of Directors appreciates and encourages your participation in the Company’s Annual Meeting. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented. Accordingly, please vote your shares by proxy, on the Internet, by telephone or by mail. If you attend the Annual Meeting, you may revoke your proxy and vote in person. Your proxy is revocable in accordance with the procedures set forth in this proxy statement.

| By order of the Board of Directors, | ||

| ||

| Steven R. Mumma | ||

| Chairman and Chief Executive Officer | ||

| New York, New York | ||

TABLE OF CONTENTS

Page | |

| GENERAL INFORMATION | |

| VOTING | |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | |

| PROPOSAL NO. 2: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | |

| PROPOSAL NO. 3: RATIFICATION, CONFIRMATION AND APPROVAL OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| INFORMATION ON OUR BOARD OF DIRECTORS AND ITS COMMITTEES | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

| COMPENSATION OF DIRECTORS | |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| EXECUTIVE OFFICERS | |

| SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND OUR DIRECTORS AND EXECUTIVE OFFICERS | |

| EXECUTIVE COMPENSATION | |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |

| AUDIT COMMITTEE REPORT | |

| RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| OTHER MATTERS | |

| ANNUAL REPORT | |

| “HOUSEHOLDING” OF PROXY STATEMENT AND ANNUAL REPORTS | |

275 Madison Avenue

New York, New York 10016

PROXY STATEMENT

GENERAL INFORMATION

Important Notice Regarding the Availability of Proxy Materials

for the 20162018 Stockholder Meeting to Be Held on May 12, 2016.June 4, 2018.

This proxy statement, our Annual Report on Form 10-K for the year ended December 31, 2015,2017, and

our other proxy materials are available at: http://www.proxyvote.com.

Proxy Solicitation

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors ("Board of Directors") of New York Mortgage Trust, Inc. (the “Company,” “we,” “our” or “us”) for use at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the offices of Vinson & Elkins LLP,L.L.P., 666 Fifth Avenue, 26th Floor, New York, New York 10103 on Thursday, May 12, 2016Monday, June 4, 2018 at 9:1:00 a.m.p.m., local time, and at any adjournment and postponement thereof. We mailed, through intermediaries, on or about March 31, 2016,April 20, 2018, a Notice Regarding the Availability of Proxy Materials (the “Notice”) to our stockholders of record as of March 17, 2016.April 9, 2018. As a result, beginning on the date of the mailing of the Notice, all stockholders of record had the ability to access all of the proxy materials and the Company’s Annual Report on Form 10-K for the year ended December 31, 20152017 (“20152017 Annual Report”) on a website referred to in the Notice and as set forth above. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy statement and 20152017 Annual Report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

The mailing address of our principal executive offices is 275 Madison Avenue, New York, New York 10016. We maintain an Internet website at www.nymtrust.com. Information at or connected to our website is not and should not be considered part of this proxy statement.

We will bear the costs of this solicitation including the costs of preparing, assembling and mailing proxy materials and the handling and tabulation of proxies received. In addition to solicitation through the Internet or by mail, proxies may be solicited by our directors, officers and employees, at no additional compensation, by telephone, personal interviews or otherwise. Banks, brokers or other nominees and fiduciaries will be requested to forward the Notice and information on how to access the proxy materials to beneficial owners of our common stock and to obtain authorization for the execution of proxies. We will, upon request, reimburse such parties for their reasonable expenses in forwarding proxy materials to beneficial owners.

No person is authorized to give any information or to make any representation not contained in this proxy statement and, if given or made, you should not rely on that information or representation as having been authorized by us. The delivery of this proxy statement shall not, under any circumstances, imply that there has been no change in the information set forth since the date of this proxy statement.

Purposes of the Annual Meeting

The principal purposes of the Annual Meeting are to: (1) elect the fivesix directors nominated and recommended by our Board of Directors, each to serve until the 20172019 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified (“Proposal No. 1”); (2) to hold an advisory vote to approve named executive officer compensation (“Proposal No. 2”); (3) consider and act upon a proposal to ratify, confirm, and approve the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20162018 (“Proposal No. 3”); and (4) transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. Our Board of Directors knows of no other matters other than those stated above to be brought before the Annual Meeting.

VOTING

How to Vote Your Shares

You may vote your shares at ourthe Annual Meeting in person. If you cannot attend ourthe Annual Meeting in person, or you wish to have your shares voted by proxy even if you do attend ourthe Annual Meeting, you may vote by duly authorized proxy on the Internet, by telephone or by mail. We encourage you to follow the instructions on how to vote as described below and as set forth in the Notice and the proxy card. Maryland law provides that a vote by Internet or telephone carries the same validity as your completion and delivery of a proxy card. In order to vote on the Internet, you must first go to http://www.proxyvote.com, have your Notice or proxy card in hand and follow the instructions.

In order to vote by telephone, you must call (800) 690-6903, have your Notice or proxy card in hand and follow the instructions.

Stockholders of record may vote by signing, dating and returning a proxy card in a postage-paid envelope. You may request a proxy card postage-paid envelope from us as instructed in the Notice. Properly signed and returned proxies will be voted in accordance with the instructions contained therein.

Registered Holders, Beneficial Owners and “Broker Non-Votes”

Registered Holders. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the registered stockholder of record with respect to those shares, and a Notice is being sent directly to you. As the registered stockholder of record, you have the right to grant your voting proxy directly to the Company through a proxy card, through the Internet or by telephone or to vote in person at the Annual Meeting.

If you are a registered stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors, or you sign and return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by our Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners and “Broker Non-Votes.” A large number of our stockholders hold their shares through a broker, trustee, bank or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank, trustee or other nominee, you are considered the beneficial owner of the shares, while the broker, trustee, bank or nominee holding your shares is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, trustee, bank or other nominee on how to vote and are also invited to attend the Annual Meeting. If your shares are held in this manner, your broker, trustee, bank or other nominee will provide you with instructions for you to use in accessing the proxy materials and directing the broker, trustee, bank or other nominee on how to vote your shares. If your shares are not directly registered in your own name and you plan to vote your shares in person at the Annual Meeting, you must contact the bank, broker, trustee or other nominee that holds your shares to obtain a legal proxy or broker’s proxy card and bring it to the Annual Meeting in order to vote.

If you are the beneficial owner of shares that are held in a stock brokerage account or by a bank or other nominee and you do not provide the organization that holds your shares with specific voting instructions, by rule, the organization that holds your shares may generally vote at its discretion on routine matters only. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform Broadridge Financial Solutions, Inc., which is receiving and tabulating the proxies, that it does not have the authority to vote your shares on non-routine matters. This is generally referred to as a “broker non-vote.” Because the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm is a routine matter for which specific instructions from beneficial owners are not required, no broker non-votes will arise in the context of voting for the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2018. Conversely, the election of directors is a non-routine matter for which specific instructions from beneficial owners are required and thus, broker non-votes may arise. Additionally, the Securities and Exchange Commission ("SEC"(“SEC”) has specifically prohibited broker discretionary voting of uninstructed shares with respect to the advisory vote to approve named executive officer compensation. As a result, if you hold your shares through a broker, bank or other nominee, your broker, bank or other nominee cannot vote your shares on the election of directors or the advisory vote to approve named executive officer compensation in the absence of your specific instructions as to how to vote on these matters. In order for your vote to be counted, please make sure that you provide specific voting instructions to your broker, bank or other nominee.

How to Revoke Your Proxy

If you have already voted your proxy on the Internet or by telephone or returned your proxy to us by mail, you may revoke your proxy at any time before it is exercised at ourthe Annual Meeting by any of the following actions:

by notifying our Investor Relations in writing that you would like to revoke your proxy;

by completing, at or before ourthe Annual Meeting, a proxy card on the Internet, by telephone or by mail with a later date; or

by attending ourthe Annual Meeting and voting in person. (Note, however, that your attendance at ourthe Annual Meeting, by itself, will not revoke a proxy you have already returned to us; you must also vote your shares in person at ourthe Annual Meeting to revoke an earlier proxy.)

If your shares of common stock are held on your behalf by a broker, bank or other nominee, you must contact them to receive instructions as to how you may revoke your proxy instructions.

Record Date for Our Annual Meeting; Who Can Vote at Our Annual Meeting; Voting Procedures and Vote Required

Our Board of Directors has fixed the close of business on March 17, 2016April 9, 2018 as the record date for the determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. On all matters to come before the Annual Meeting, each holder of record of our common stock as of the close of business on March 17, 2016April 9, 2018 will be entitled to vote at the Annual Meeting and will be entitled to one vote for each share of common stock owned as of such date. As of the close of business on March 17, 2016,April 9, 2018, the Company had 109,409,236112,111,386 shares of common stock outstanding.

The representation in person or by proxy of a majority of all the votes entitled to be cast on the matters to be considered at the meeting is necessary to provide a quorum for the transaction of business at the Annual Meeting. Your shares will be counted as present at the Annual Meeting if you are present and entitled to vote at the Annual Meeting, or you have properly submitted a proxy card or voting instruction card, or voted by telephone or over the Internet. Both abstentions and broker non-votes are counted for purposes of determining the presence of a quorum. If a quorum is not present, the Annual Meeting may be adjourned by the vote of a majority of the shares represented at the Annual Meeting until a quorum has been obtained.

With respect to the election of directors, the vote of a plurality of all the votes cast at the Annual Meeting at which a quorum is present is necessary for the election of a director. The fivesix nominees who receive the most votes will be elected. There is no cumulative voting in the election of directors. Abstentions and broker non-votes will not be counted as votes cast and, because the vote of a plurality is required, will have no effect on the result of the vote for election of directors.

With respect to the advisory vote to approve named executive officer compensation, the affirmative vote of a majority of the votes cast on these mattersthis proposal at the Annual Meeting is necessary for approval, on an advisory basis, of our named executive officer compensation. Abstentions and broker non-votes will not count as votes cast on the advisory vote to approve named executive officer compensation, and thus will have no effect on the result of the vote on this proposal.

With respect to the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm, the affirmative vote of a majority of the votes cast on this matter at the Annual Meeting is necessary for ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2018. Abstentions will not count as votes cast on this proposal and thisthus will have no effect on the result of the vote. As noted above, no broker non-votes will arise in the context of the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2018.

Pursuant to our charter, holders of shares of our common stock are not entitled to exercise appraisal rights under the Maryland General Corporation Law unless our Board of Directors, upon the affirmative vote of a majority of our Board of Directors, shall determine that such rights apply to one or more transactions occurring after the date of such determination. Our Board of Directors has made no such determination with respect to the business to be considered at the Annual Meeting.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

The fivesix persons named below have been nominated to serve on our Board of Directors until the 20172019 Annual Meeting of Stockholders or until such time as their respective successors are elected and qualified. Our Board of Directors is currently comprised of six directors, five directors.of whom are independent in accordance with our Corporate Governance Guidelines and the listing standards of the Nasdaq Stock Market (“Nasdaq”). Each nominee is currently a director of the Company and has consented to stand for election at the Annual Meeting. The Board of Directors has no reason to believe that the persons named below as nominees for directors will be unable, or will decline to serve, if elected. For additional information regarding our corporate governance and these nominees, see “Information on Our Board of Directors and Its Committees” below.

Board Considerations in Recommending These Nominees

Our Board of Directors believes that the Board of Directors, as a whole, should encompass a range of talent, skill, diversity and expertise enabling it to provide sound guidance with respect to our operations and interests. In identifying qualified director nominees, the Nominating & Corporate Governance Committee of our Board of Directors, and our Board of Directors consider, among other things, a candidate'scandidate’s experience, skills, accomplishments, background, age, diversity, willingness to serve and commitment to the Company, and then review those qualities in the context of the current composition of our Board of Directors and the evolving needs of our business. Because we are listed on the Nasdaq Global Select Market, we are required to have at least a majority of our directors qualify as “independent,” as such term is defined by the Nasdaq Stock Market ("Nasdaq").Nasdaq. The Nominating & Corporate Governance Committee identifies candidates for election to our Board of Directors with input from our other directors, reviews the qualities listed above and recommends to our Board of Directors individual nominees for director.

Our Board of Directors seeks director nominees with strong reputations, and experience, competence or expertise in areas relevant to the strategy and operations of our business, particularly in the finance or mortgage industries.industries, or the proper and effective functioning of our Board of Directors. Each of the nominees for election as a director at the Annual Meeting holds or has held important positions and has operating experience or other relevant experience that meets this objective. In these positions, they have also gained experience in some or all of the following: core management skills, such as strategic and financial planning, public company financial reporting, accounting, corporate governance, risk management and leadership development.

Our Board of Directors also believes that each of the nominees listed below has other key attributes that are important to a properly functioning and effective board, including integrity and high ethical standards, sound judgment, analytical skills, the ability and desire to engage management and each other in a constructive fashion, and the commitment to devote significant time and energy to service on our Board of Directors and its committees.

Nominees for Election as Directors

The following table sets forth the names and biographical information concerning each of the directors nominated for election at the Annual Meeting:

| Name | Principal Occupation | Director Since | Age | Principal Occupation | Director Since | Age | ||||||

| Steven R. Mumma† | Chairman, Chief Executive Officer and President | 2007 | 57 | Chairman and Chief Executive Officer | 2007 | 59 | ||||||

| David R. Bock* | Managing Partner of Federal City Capital Advisors | 2012 | 72 | Managing Partner of Federal City Capital Advisors | 2012 | 74 | ||||||

| Michael B. Clement* | Professor of Accounting at University of Texas at Austin | 2016 | 61 | |||||||||

| Alan L. Hainey* | Owner and Manager of Carolina Dominion LLC | 2004 | 69 | Owner and Manager of Carolina Dominion, LLC | 2004 | 71 | ||||||

| Douglas E. Neal | President of RiverBanc LLC | 2012 | 56 | |||||||||

| Steven G. Norcutt* | President of Schafer Richardson, Inc. | 2004 | 56 | President of Schafer Richardson, Inc. | 2004 | 58 | ||||||

| Lisa A. Pendergast* | Executive Director of Commercial Real Estate Finance Council | 2018 | 56 | |||||||||

| * | Our Board of Directors has affirmatively determined that these director nominees currently are independent under the criteria described below in “Information on Our Board of Directors and Its Committees—Independence of Our Board |

| † | Chairman of our Board of Directors. |

Steven R. Mumma is our Chairman and Chief Executive Officer and President.Officer. Mr. Mumma has served as Chairman of our Board of Directors effective since March 30, 2015. Mr. Mumma has served as Chief Executive Officer since February 3, 2009. Mr. Mumma was appointed President, a role he held until May 2016, and Co-Chief Executive Officer effective March 31, 2007, which marked the divestment of the Company’s mortgage lending business, and served as Chief Financial Officer from November 2006 to October 2010. Prior to serving in the above capacities, Mr. Mumma served as our Chief Investment Officer, a position to which he was named in July 2005, and as Chief Operating Officer, commencing in November 2003. From September 2000 to September 2003, Mr. Mumma was a Vice President of Natexis ABM Corp., a wholly-owned subsidiary of Natexis Banques Populaires. From 1997 to 2000, Mr. Mumma served as a Vice President of Mortgage-Backed Securities trading for Credit Agricole. Prior to joining Credit Agricole, from 1988 to 1997, Mr. Mumma was a Vice President of Natexis ABM Corp. Prior to joining Natexis ABM Corp., from 1986 to 1988, Mr. Mumma was a Controller for PaineWebber Real Estate Securities Inc., the mortgage-backed trading subsidiary of PaineWebber Inc. Prior to joining PaineWebber, from 1981 to 1985, Mr. Mumma worked for Citibank in its Capital Markets Group, as well as for Ernst & Young LLP. Mr. Mumma received a B.B.A. cum laude from Texas A&M University.

Our Board of Directors concluded that Mr. Mumma should serve as a director of the Company because of his significant operational, financial and accounting experience in, and knowledge of, the Company, which he has served since shortly after our inception in 2003, and the broader mortgage-backed securities industry, where he has worked for more than 20 years. As Chairman and Chief Executive Officer and President of the Company, Mr. Mumma also serves as a critical link between management and our Board of Directors.

David R. Bock has served as a member of our Board of Directors since January 2012. Mr. Bock is a Managing Partner of Federal City Capital Advisors, a Washington, D.C.-basedDC-based business and financial advisory services company, and has held this position since 2004. Mr. Bock has a background in international economics and finance, capital markets and organizational development, having served as a Managing Director of Lehman Brothers and in various executive roles at the World Bank, including as the chief of staff for the World Bank’s lending operations. Mr. Bock was the Chief Financial Officer of I-Trax, Inc., a publicly traded healthcare company prior to its sale to Walgreen’s in 2008, and previously the Chief Financial Officer of Pedestal Inc., an online mortgage trading platform. Mr. Bock served as interim Chief Executive Officer of Oxford Analytica in 2010. Mr. Bock began his professional career with McKinsey & Co. following completion of an advanced degree in economics from Oxford University, where he was a Rhodes Scholar. He received a B.A. in philosophy from the University of Washington. Mr. Bock currently serves on the Boards of the Pioneer Funds complex, where he serves as chairman of the audit committee, the Swiss-Helvetia Fund, where he also serves on the audit committee, and Oxford Analytica, as well as various private and charitable organizations. Mr. Bock previously served on our Board of Directors from 2004 to 2009.

Our Board of Directors concluded that Mr. Bock should serve as a director of the Company because of his extensive expertise in economics, finance and accounting and his prior experiences in our industry, as well as his prior experiences as a Chief Financial Officer, Chief Executive Officer and director of other companies.

Michael B. Clement has served as a member of our Board of Directors since June 2016. Mr. Clement has been a professor in the Department of Accounting at the University of Texas at Austin since 2011 and has held associate professor and assistant professor positions in the Department of Accounting at the University of Texas at Austin since 1997. Mr. Clement was the Vice President of Global Investment Research for Goldman Sachs & Co. from 2002 until 2004. Mr. Clement was the Vice President of Capital Planning and Analysis from 1988 to 1991 and a Manager of the Audit Division from 1982 to 1986 at Citicorp. Prior to his employment at Citicorp, Mr. Clement was a Senior Assistant Accountant at Deloitte Haskins & Sells. Mr. Clement holds a B.B.A. in Accounting from Baruch College, an M.B.A. in Finance from the University of Chicago and a Ph.D. in Accounting from Stanford University.

Our Board of Directors concluded that Mr. Clement should serve as a director of the Company because of his significant expertise in accounting and his prior experience working in the finance industry.

Alan L. Hainey has served as a member of our Board of Directors since the completion of our initial public offering (“IPO”) in June 2004 and became our Lead Director onin March 30, 2015. Mr. Hainey is the owner and manager of Carolina Dominion, LLC, a real estate brokerage development and investment firm that he founded in 2004. In 2001, Mr. Hainey incorporated and funded the Merrill L. Hainey Family Foundation, a not-for-profit charitable organization dedicated to academic achievement through scholarships, where he continues to serve as President. From 1996 to 2000, Mr. Hainey operated an independent consulting practice providing advisory and marketing services to clients engaged in insurance, mortgage finance and investment management. From 1990 to 1996, Mr. Hainey served as President and Chief Operating Officer of GE Capital’s mortgage banking businesses and was a member of GE Capital's corporate executive council. From 1983 to 1990, Mr. Hainey served as President of GE Capital Mortgage Securities. Mr. Hainey received a B.A. with honors and a J.D. from the University of Missouri and a Master of Management with distinction from the Kellogg School of Northwestern University.

Our Board of Directors concluded that Mr. Hainey should serve as a director of the Company because of his valuable business, leadership and management skills obtained during his 30-plus years in the mortgage banking business, including as President of GE Capital’s mortgage banking business and as a member of its executive council.

Steven G. Norcutt has served as a member of our Board of Directors since completion of our IPO in June 2004. Mr. Norcutt has served since October 2009 as the President of Schafer Richardson, Inc., a commercial real estate management, construction, development, leasing and investment company based in Minneapolis, Minnesota. From April 2008 to October 2009, Mr. Norcutt served as Senior Vice President – Regional Manager of Guaranteed Rate Mortgage, a residential mortgage banking company headquartered in Chicago, Illinois. Prior to joining Guaranteed Rate, Mr. Norcutt served as Executive Vice President and Chief Operating Officer of Centennial Mortgage and Funding, Inc., a residential mortgage banking company based in Minnesota. Prior to joining Centennial Mortgage and Funding, Inc., Mr. Norcutt served as Senior Vice President and Portfolio Manager of Structured Finance for Reliastar Investment Research, Inc. from 1993 through 2001. Mr. Norcutt joined Reliastar Investment Research, Inc. in 1988 as Vice President and Portfolio Manager of Residential Mortgage Loans. Mr. Norcutt received an M.B.A. in Finance from the Carlson School of Business at the University of Minnesota and a B.S. in Finance from St. Cloud State University.

Our Board of Directors concluded that Mr. Norcutt should serve as a director of the Company because of his extensive operating, business and financial experience from significant tenures in both the mortgage lending and mortgage portfolio management businesses, as well as his current role as President of a commercial real estate company.

Lisa A. Pendergast joined our Board of Directors in March 2018. Ms. Pendergast is currently Executive Director of Commercial Real Estate Finance Council, a trade organization with over 305 member companies and over 9,000 individual members that covers the commercial and multi-family real estate finance markets, a position she has held since September 2016. Ms. Pendergast was Managing Director of the Commercial Mortgage-Backed Securities Strategy and Risk division of Jefferies LLC from 2009 to June 2016. From 2001 to 2009, Ms. Pendergast was Managing Director of the Commercial Mortgage-Backed Securities Strategy division of RBS Greenwich Capital. Prior to her employment at RBS Greenwich Capital, Ms. Pendergast was Managing Director in the Financial Strategies Group at Prudential Securities from 1987 to 2000. Ms. Pendergast holds a B.A. in English Literature and Political Science from Marymount College of Fordham University.

Our Board of Directors concluded that Ms. Pendergast should serve as a director of the Company because of her extensive relevant experience in the commercial and residential real estate markets, as well as her significant expertise in commercial credit and structured finance. Ms. Pendergast's name as a potential candidate for director was initially referred to the Nominating & Corporate Governance Committee by our Chief Executive Officer.

Our Board of Directors recommends that stockholders vote “FOR” the election of each of the nominees.

PROPOSAL NO. 2: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), added by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) provides our stockholders with an advisory vote to approve our named executive officer compensation. This advisory vote gives our stockholders the opportunity to express their views on the compensation of our named executive officers. Although this vote is advisory and is not binding, the Board of Directors and the Compensation Committee plan to take into consideration the outcome of the vote when making future executive compensation decisions.

At our 2013 Annual Meeting of Stockholders, a majority of stockholders voted in favor of having an advisory vote to approve our named executive officer compensation each year, consistent with the recommendation of our Board.Board of Directors. After consideration of these results and our Board’sBoard of Director’s recommendation, we elected to hold future advisory votes on named executive officer compensation each year until the next advisory vote on frequency occurs. We are required under the Dodd-Frank Act to hold an advisory vote on the frequency of the advisory votes to approve named executive officer compensation at least every six years.

As described in detail under “Executive Compensation—Compensation Discussion and Analysis,” our compensation program for 20152017 was designed to compensate our named executive officers in a manner that attracts and retains top performing employees, motivates our management team by tying compensation to our financial performance, and rewards exceptional individual performance that supports our overall objectives, while also consistent with our needs as a company to maintain an appropriate expense structure. Our Board of Directors believes that our current executive compensation program compensates our named executive officers in an appropriate manner in relation to the size and performance of the Company and properly aligns the interests of our named executive officers with those of our stockholders. We utilized the 2013 Incentive Compensation Plan (the “Incentive Plan”) as effective for fiscal year 2015,2017 (the “2017 Annual Incentive Plan”), a performance-based incentive compensation plan that serves as a means of linking compensation both to our overall performance and to objective and subjective performance criteria that are within the control of our named executive officers, for determining incentive compensation payable to our named executive officers for performance in 2015.2017.

See the information set forth under “Compensation“Executive Compensation—Compensation Discussion and Analysis” and “Executive Compensation—Executive Compensation Information” for more information on these elements of our named executive officer compensation program.

For these reasons, the Board of Directors strongly endorses our named executive officers compensation program and recommends that stockholders vote in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed under the compensation disclosure rules of the SEC, including the “Compensation“Executive Compensation—Compensation Discussion and Analysis,” compensation tables and narrative discussion contained in the proxy statement for the 2016 annual meeting2018 Annual Meeting of stockholders.Stockholders.”

Our Board of Directors recommends that stockholders vote FOR“FOR” the approval, on an advisory basis, of our named executive officer compensation.

PROPOSAL NO. 3: RATIFICATION, CONFIRMATION AND APPROVAL OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors is directly responsible for the appointment, evaluation, compensation, retention and oversight of the independent registered public accounting firm that audits our financial statements and our internal control over financial reporting. The Audit Committee has appointed Grant Thornton LLP, or Grant Thornton, as our independent registered public accounting firm for the fiscal year ending December 31, 2016. 2018. Grant Thornton has served as our independent registered public accounting firm since December 2009.

The Audit Committee annually reviews Grant Thornton’s independence and performance in deciding whether to retain Grant Thornton or engage a different independent registered public accounting firm. In the course of these reviews, the Audit Committee considers, among other things:

Grant Thornton's historical and recent performance on our audit;

Grant Thornton's capability and expertise in handling the breadth and complexity of our business;

Appropriateness of Grant Thornton's fees for audit and non-audit services, on both an absolute basis and as compared to its peer firms; and

Grant Thornton's independence and tenure as our auditor.

Based on this evaluation, the Audit Committee believes that Grant Thornton is independent and that it is in the best interests of our Company and our stockholders to retain Grant Thornton as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

Although stockholder approval is not required, we desire to obtain from our stockholders an indication of their approval or disapproval of the Audit Committee’s action in appointing Grant Thornton as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.2018. Although we seek ratification of the appointment of Grant Thornton as our independent registered public accounting firm, the ratification of the appointment of Grant Thornton does not preclude the Audit Committee from subsequently determining to change independent registered public accounting firms if it determines such action to be in the best interests of the Company and its stockholders. If our stockholders do not ratify, confirm and approve this appointment, the appointment will be reconsidered by the Audit Committee and our Board of Directors. We engaged Grant Thornton beginning in December 2009 to serve as our independent registered public accounting firm for the fiscal year ended December 31, 2009 and Grant Thornton has continued to serve as our independent registered public accounting firm to the date of this proxy statement.

We expect that a representative of Grant Thornton will be present at the Annual Meeting where the representative will be afforded an opportunity to make a statement and to respond to appropriate questions.

Our Board of Directors recommends that you vote “FOR” the ratification, confirmation and approval of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.2018.

INFORMATION ON OUR BOARD OF DIRECTORS AND ITS COMMITTEES

Five of our six directors are independent.

Independent Audit, Compensation and President, has also served as the ChairmanNominating & Corporate Governance Committees.

Independent Lead Director.

Independent directors met in executive sessions of our Board of Directors and Alan L. Hainey has served as our Lead Director. Mr. Mumma succeeded Douglas E. Neal as the Chairmanon five occasions.

Annual election of all directors.

33% of our Board of Directors are diverse based on gender, race or ethnicity.

Average director tenure equals 7.8 years.

Three of our four Audit Committee Members qualify as “audit committee financial experts.”

No shareholder rights plan or “poison pill.”

No “related person transactions” in 2017.

Our non-employee directors and Chief Executive Officer are subject to robust stock ownership guidelines.

Directors and executive officers are prohibited from engaging in short-selling, pledging or hedging transactions involving our securities.

Our Chief Executive Officer's equity awards will not accelerate or vest solely due to a position Mr. Neal held from April 2012 until Mr. Mumma's appointment.change in control.

Independence of Our Board of Directors

Our Corporate Governance Guidelines and the listing standards of the Nasdaq require that a majority of our directors be independent. Our Board of Directors has adopted the categorical standards prescribed by the Nasdaq to assist our Board of Directors in evaluating the independence of each of theour directors. The categorical standards describe various types of relationships that could potentially exist between a board member and the Company and sets thresholds at which such relationships would be deemed to be material. Provided that no relationship or transaction exists that would disqualify a director under the categorical standards and our Board of Directors affirmatively determines that the director has no material relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, including certain business relationships for which disclosure may be required in this proxy statement, our Board of Directors will deem such person to be independent. A director shall not be independent if he or she satisfies any one or more of the following criteria:

A director who is, or who has been within the last three years, an employee of the Company, or whose immediate family member is, or has been within the last three years, employed as an executive officer of the Company;

A director who has accepted or who has an immediate family member, serving as an executive officer, who has accepted, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company (excluding compensation for board or board committee service, compensation paid to an immediate family member who is an employee of the Company (but not an executive officer of the Company), and benefits under a tax-qualified retirement plan, or non-discretionary compensation);

A director who is, or whose immediate family member is, a current partner of a firm that is the Company’s internal or external auditor, or was a partner or employee of the Company’s outside auditor who worked on our Company’s audit at any time during any of the past three years;

A director who is, or whose immediate family member is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of the Company served on the compensation committee of such other entity; or

A director who is, or whose immediate family member is, a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of that organization’s consolidated gross revenues for that year, or $200,000, whichever is greater, other than (i) payments arising solely from investments in that organization’s securities, and (ii) payments under non-discretionary charitable contribution matching programs.

Our Board of Directors will also consider a director’s charitable relationships when assessing director independence.

Under these criteria, our Board of Directors has determined that the following members of our Board of Directors are independent: David R. Bock, Michael B. Clement, Alan L. Hainey, Steven G. Norcutt, and David R. Bock.Lisa A. Pendergast. We presently have fivesix directors, including these threefive independent directors.

To assist in the discharge of its responsibilities, our Board of Directors has established three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Nominating & Corporate Governance Committee. The principal responsibilities of each committee are described below. Actions taken by any committee of our Board of Directors are reported to our Board of Directors, usually at the meeting following such action. Each standing committee has a written charter, a current copy of which is available for review on our website at www.nymtrust.com.

Audit Committee

The Audit Committee of our Board of Directors is comprised of Messrs. BockClement (Chairman), Bock, Hainey and Norcutt. Our Board of Directors has determined that each of the Audit Committee members is independent, as that term is defined under the enhanced independence requirements for audit committee members set forth in the rules of the SEC and in accordance with the Company’s independence criteria discussed under “—Independence of Our Board of Directors,” and that each of the members of the Audit Committee can read and understand fundamental financial statements and as such, is financially literate, as that term is interpreted by our Board of Directors. In addition, our Board of Directors has determined that each of Messrs. Bock, Clement and Norcutt is an “audit committee financial expert” as that term is defined in the SEC rules. For more information regarding the relevant experience of our audit committee financial experts, see each such individual's biography set forth under “Proposal No. 1: Election of Directors—Nominees for Election as Directors.” Mr. Bock also serves on the board and audit committee of the more than 5040 funds that comprise the Pioneer Funds complex. Our Board of Directors considers the Pioneer Funds complex to be one fund for purposes of the Audit Committee’s charter.

The Audit Committee operates under a written charter adopted by our Board of Directors. The primary purpose and responsibilities of the Audit Committee include, among other things:

•assisting our Board of Directors in fulfilling its oversight responsibility relating to:

| ▪ | the integrity of our financial statements and financial reporting process, our systems of internal accounting and financial controls and other financial information provided by us; |

| ▪ | our compliance with legal and regulatory requirements; and |

| ▪ | the evaluation of risk assessment and risk management policies; |

overseeing the audit and other services of our independent registered public accounting firm, including the selection of the lead audit engagement partner, and being directly responsible for the appointment, replacement, evaluation, independence, qualifications, compensation and oversight of our independent registered public accounting firm, who will reportreports directly to the Audit Committee;

monitoring non-audit services provided by the independent registered public accounting firm and the related fees for such services for purposes of determining the independence of the independent registered public accounting firm;

fostering open communication, including meeting periodically with management, the internal auditor and the independent registered public accounting firm in separate executive sessions to discuss any matters that the Audit Committee or any of these groups believe should be discussed privately;

reviewing and discussing with management and the auditors our quarterly and annual financial statements and report on internal control and the independent registered public accounting firm’s assessment thereof; and

reviewing and approving related party and conflict of interest transactions and preparing the audit committee report for inclusion in our annual proxy statements for our annual stockholder meeting.meetings.

The Audit Committee met eight15 times during the year ended December 31, 2015.2017 and met four times in executive session with our independent registered public accounting firm. For more information, please see “Audit Committee Report” herein.

Compensation Committee

The Compensation Committee of our Board of Directors is comprised of Messrs. Norcutt (Chairman), HaineyBock, Clement and Bock.Hainey. Our Board of Directors has determined that each of the Compensation Committee members is independent in accordance with the Company’s independence criteria discussed under “—Independence of Our Board of Directors” and the independence standards of the Nasdaq that apply to Compensation Committee members. The Compensation Committee operates under a written charter adopted by our Board of Directors. In addition, the Compensation Committee administers our incentive compensation plans and equity-based compensation plans and programs, including our 2010 Stock Incentive Plan (the “2010 Stock Plan”) and the Incentive Plan.programs. The Compensation Committee’s basic responsibility is to ensure that our Chief Executive Officer and President andother key members of management are compensated fairly and effectively in a manner consistent with the Company’s stated compensation strategy, competitive practice, applicable regulatory requirements and performance results.

The Compensation Committee met sevennine times during the year ended December 31, 2015.2017.

Nominating & Corporate Governance Committee

The Nominating & Corporate Governance Committee of our Board of Directors is comprised of Messrs. Hainey (Chairman), NorcuttBock, Clement and Bock.Norcutt. Our Board of Directors has determined that each of the Nominating & Corporate Governance Committee members is independent in accordance with the independence criteria discussed under “—Independence of Our Board of Directors.” The Nominating & Corporate Governance Committee operates under a written charter adopted by our Board of Directors. Among other duties, this committee:

identifies, selects, evaluates and recommends to our Board of Directors candidates for service on our Board; and

oversees the evaluation of our Board of Directors and management.management; and

oversees compliance with our stock ownership guidelines for non-employee directors and our Chief Executive Officer.

The Nominating & Corporate Governance Committee met four times during the year ended December 31, 2015.2017.

Other Committees

From time to time, our Board of Directors may establish other committees as circumstances warrant. Those committees will have the authority and responsibility as delegated to them by our Board of Directors.

Executive Sessions of Our Non-Management and Independent Directors

The non-managementindependent directors of our Board of Directors will occasionally meet in executive session that excludes members of the management team. In addition,During 2017, the independent directors of our Board of Directors occasionally meetmet in executive sessions that exclude non-independent directors.session five times. Our Board of Directors has established a process by which the Lead Director will preside over meetings of our independent directors. Pursuant to this process, the Lead Director has the power to lead the meetings of our non-management directors and our independent directors, set the agenda and determine the information to be provided. However, in practice, these meetings tend to be less formal procedurally and, generally, allow for each participant to raise such matters and discuss such business as that independent director deems necessary or desires. Stockholders and other interested persons may contact the Lead Director, who is independent, in writing by mail c/o New York Mortgage Trust, Inc., 275 Madison Avenue, New York, New York 10016, Attention: Secretary. All such letters will be forwarded to the Lead Director. For more information on how to communicate with our other directors, see “—Communications with Our Board of Directors.”

Board Leadership Structure

Pursuant to our Corporate Governance Guidelines, our Board of Directors has not established a fixed policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board.Board of Directors. Instead, the Board of Directors believes this determination is part of the succession planning process and should be considered upon the appointment or re-appointment of a chief executive officer.

Our Board of Directors is currently led by its Chairman, Steven R. Mumma, who also serves as our Chief Executive Officer and President.Officer. Mr. Mumma was appointed as the Chairman of our Board of Directors, effective March 30, 2015. In connection with Mr. Mumma’s appointment as Chairman, our Board of Directors has adopted a policy that provides that in the event our Chairman is also an executive officer of the Company, our independent directors will select a Lead Director from among themselves. Mr. Alan Hainey, an independent director of the Company since 2004, serves as our Lead Director, a role he was initially appointed to on March 30, 2015. Our Lead Director's role exists, according to our Board’sBoard of Director’s policy, (i) to provide leadership to our Board of Directors when the joint roles of Chairman and Chief Executive Officer could potentially be in conflict; (ii) to ensure that our Board of Directors operates independently of management; and (iii) to provide our directors with an independent leadership contact.

Our Lead Director's responsibilities, as set forth in our Board of Directors’ policy, include:

chairing an executive session during each Board of Directors meeting without management (including without our Chairman and Chief Executive Officer) present in order to give independent directors an opportunity to fully and frankly discuss issues, and to provide feedback and counsel to our Chairman and Chief Executive Officer concerning the issues considered;

reviewing and discussing with our Chairman and Chief Executive Officer the matters to be included in the agenda for meetings of our Board of Directors;

acting as liaison between our Board of Directors and the Chief Executive Officer;

establishing, in consultation with our Chairman and Chief Executive Officer, and with the Nominating & Corporate Governance Committee, procedures to govern and evaluate our Board of Directors'Directors’ work, to ensure, on behalf of stockholders, that our Board of Directors is (i) appropriately approving our corporate strategy;strategy and (ii) supervising management's progress against achieving that strategy; and

ensuring the appropriate flow of information to our Board of Directors and reviewing the adequacy and timing of documentary materials in support of management's proposals.

Our Board of Directors has vested the offices of Chairman President and Chief Executive Officer in Mr. Mumma because it believes that combining the roles of Chairman President and Chief Executive Officer facilitates the flow of information between management and our Board of Directors, while providing the appropriate balance between independent oversight of management and efficiency of the operation of our Board of Directors. Furthermore, our Board of Directors believes that having our Board of Directors'Directors’ deliberation of strategic alternatives framed by the person who (i) is the most knowledgeable about the Company and its industry, (ii) has been most instrumental in transforming the Company from a vertically integrated residential mortgage origination and portfolio investment manager into a diversified investment portfolio manager, and (iii) is responsible for executing our strategy is the optimal means for our Board of Directors to discharge its responsibility of establishing strategy. For these reasons, we believe our Board leadership structure is appropriate for the Company and does not affect our Board of Directors’ approach to risk oversight.

Our Board’s Role in Risk Oversight

We face a variety of risks, including interest rate risk, credit risk, and liquidity risk, many of which are discussed under “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 7A. Quantitative and Qualitative Disclosures About Market Risk,” each included in our Annual Report on Form 10-K for the year ended December 31, 2015.2017. Our Board of Directors believes an effective risk management system will (1) timely identify the material risks that we face, (2) communicate necessary information with respect to material risks to our Chairman and Chief Executive Officer and President or other officers of the Company and, as appropriate, to our Board of Directors or relevant committee thereof, (3) implement appropriate and responsive risk management strategies consistent with our risk profile, and (4) integrate risk management into management and our Board’sBoard of Director’s decision-making.

Our Board of Directors has designated the Audit Committee to take the lead in overseeing risk management, and the Board of Directors and the Audit Committee receive joint briefings provided by management and advisors regarding the adequacy of our risk management processes. Our Board of Directors believes that an overall review of risk is inherent in its consideration of our long-term strategies and in the transactions and other matters presented to it. The Board of Director’s role in risk oversight of the Company is consistent with our leadership structure, with the Chief Executive Officer and President and other members of senior management having responsibility for assessing and managing our risk exposure, and our Board of Directors and the Audit Committee providing oversight of those efforts.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our executive officers, including our principal executive officer and principal financial officer, and to our other employees. We have also adopted a Code of Ethics for senior financial officers, including the principal financial officer. We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K relating to amendments to or waivers from any provision of either of these Code of Ethics applicable to our chiefprincipal executive officer and chiefprincipal financial officer by posting such information on our website at www.nymtrust.com, Corporate Governance.“Corporate Governance”.

Availability of Corporate Governance Materials

Stockholders may view our corporate governance materials, including the written charters of the Audit Committee, the Compensation Committee and the Nominating & Corporate Governance Committee, our Corporate Governance Guidelines, our Code of Business Conduct and Ethics and our Code of Ethics for senior financial officers, on our website at www.nymtrust.com under the “Corporate Governance” section of the website. A copy of any of these documents will be provided free of charge to any stockholder upon request by writing to New York Mortgage Trust, Inc., 275 Madison Avenue, New York, New York 10016, Attention: Investor Relations. Information at or connected to our website is not and should not be considered a part of this proxy statement.

Director Nominations

The Nominating & Corporate Governance Committee of our Board of Directors performs the functions of a nominating committee, including identifying, evaluating and recommending to our Board of Directors candidates for service on our Board of Directors who satisfy the qualification requirements described in our Corporate Governance Guidelines.

The Nominating & Corporate Governance Committee’s charter provides that the committee will consider candidates recommended by stockholders for service on our Board of Directors. Stockholders should submit any such recommendations for the consideration of the Nominating & Corporate Governance Committee through the method described under “Communications“—Communications with Our Board of Directors” below. In addition, any stockholder of record entitled to vote for the election of directors at the 20172019 Annual Meeting of Stockholders may nominate persons for election to our Board of Directors if that stockholder complies with the notice procedures summarized in “Stockholder“—Stockholder Proposals for Our 20172019 Annual Meeting” below.

The Nominating & Corporate Governance Committee evaluates all director candidates in accordance with the director qualification standards described in our Corporate Governance Guidelines. The committee evaluates any candidate’s qualifications to serve as a member of our Board of Directors based on various criteria, including a nominee's experience, skills, accomplishments, background, age and diversity, and then reviews those qualifications in the context of the current composition of our Board of Directors and the evolving needs of our business. In addition, the Nominating & Corporate Governance Committee will evaluate a candidate’s independence, diversity, skills and experience in the context of our Board of Directors’ needs.

We do not have a formal policy with regard to the consideration of diversity in identifying director nominees, but our Board of Directors and the Nominating & Corporate Governance Committee strive to nominate directors with a variety of complementary skills so that, as a group, our Board of Directors will possess the appropriate talent, skills and expertise to oversee our business. Although we have no policy regarding diversity, both our Board of Directors and the Nominating & Corporate Governance Committee seek a broad range of perspectives and consider many factors, including the personal characteristics (gender, ethnicity, age and background) and experience (industry, professional and public service) of directors and prospective nominees to our Board of Directors.

Communications with Our Board of Directors

We provide a process for stockholders to send communications to our Board of Directors. Stockholders can send communications to our Board of Directors and, if applicable, to any committee or to specified individual directors in writing to such committee or individual director, c/o New York Mortgage Trust, Inc., 275 Madison Avenue, New York, New York 10016, Attention: Secretary. We do not screen mail, except when warranted for security purposes, and all such letters will be forwarded to our Board of Directors and any such specified committee or individual directors.

Stockholder Proposals for Our 20172019 Annual Meeting

Our Board of Directors will provide for presentation of proposals by our stockholders at the 20172019 Annual Meeting of Stockholders, provided that these proposals are submitted by eligible stockholders who have complied with the relevant regulations of the SEC regarding stockholder proposals.

Stockholders intending to submit proposals for presentation at our 20172019 Annual Meeting of Stockholders, tentatively scheduled to be held in May 2017,June 2019, must submit their proposals in writing, and we must receive these proposals at our executive offices on or before December 2, 201621, 2018 for inclusion in our proxy statement and the form of proxy relating to our 20172019 Annual Meeting of Stockholders. We will determine whether or not to include any proposal in our proxy statement and form of proxy on a case-by-case basis in accordance with our judgment and the regulations governing the solicitations of proxies and other relevant regulations of the SEC. We will not consider proposals received after December 2, 201621, 2018 for inclusion in our proxy materials for our 20172019 Annual Meeting of Stockholders.

Although stockholder proposals received by us after December 2, 201621, 2018 will not be included in our proxy materials for the 20172019 Annual Meeting of Stockholders, stockholder proposals may be included in the agenda for the 20172019 Annual Meeting of Stockholders if properly submitted in accordance with our bylaws. Our bylaws provide that in order for a stockholder to nominate a candidate for election as a director at an annual meeting of stockholders or propose business for consideration at such meeting, notice must be given in writing to our Secretary not later than the close of business5 p.m., Eastern Time, on the 90th day prior to the first anniversary of the date of mailing of the notice for the preceding year’s annual meeting nor earlier than the close of business5 p.m., Eastern Time, on the 120th day prior to the first anniversary of the date of mailing of the notice for the preceding year’s annual meeting. As a result, any notice given by or on behalf of a stockholder pursuant to the provisions of our bylaws must be delivered in writing via personal delivery or United States certified mail, postage prepaid to our Secretary c/o New York Mortgage Trust, Inc., 275 Madison Avenue, New York, New York 10016, not earlier than December 2, 2016,21, 2018, and not later than January 1, 2017.20, 2019. The stockholder filing the notice of nomination must include:

As to the stockholder giving the notice:

| ▪ | the name and address of such stockholder and/or stockholder associated person, as they appear on our stock ledger, and current name and address, if different; |

| ▪ | the class, series and number of shares of stock of the Company beneficially owned by that stockholder and/or stockholder associated person; and |

| ▪ | to the extent known, the name and address of any other stockholder supporting the nominee for election or re-election as a director, or the proposal of other business known on the date of such stockholder’s notice. |

As to each person whom the stockholder proposes to nominate for election as a director:

| ▪ | the name, age, business address and residence address of the person; |

| ▪ | the class, series and number of shares of stock of the Company that are beneficially owned by the person; |

| ▪ | the date such shares were acquired and the investment intent of such acquisition; |

| ▪ | all other information relating to the person that is required to be disclosed in solicitations of proxies for election of directors or is otherwise required by the rules and regulations of the SEC; and |

| ▪ | the written consent of the person to be named in the proxy statement as a nominee and to serve as a director if elected. |

In order for a stockholder to bring other business before a stockholder meeting, timely notice must be received by us within the time limits described above. That notice must include:

the information described above with respect to the stockholder proposing such business;

a description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; and

any material interest of the stockholder in such business.

Directors Attendance at Meetings of our Board of Directors and Annual Meeting

Our Board of Directors held 16 meetings, including four regularly scheduled quarterly meetings, during 2015.2017. All directors who were members of our Board of Directors for the year ended December 31, 20152017 attended 75% or more of the aggregate number of meetings of the Board of Directors and its committees on which they served during 2017, with the exception of Mr. Bock, who was only able to attend 73% of such meetings due to an unexpected medical issue during the first quarter of 2017. Mr. Bock attended 32 of the 44 meetings during 2017 and 25 of the 27 meetings of our Board of Directors and of the committees on which he served following the first quarter of 2017. In addition, Mr. Bock attended 100% of the meetings of our Board of Directors and of the committees on which he served during 2016 and 2015.

We have a policy that directors attend the Annual Meeting of Stockholders. Each member of our Board of Directors who was a director of the Company at the time of our 20152017 Annual Meeting of Stockholders attended the 20152017 Annual Meeting of Stockholders.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related Person Transaction Policy

Our Board of Directors has adopted a policy regarding the approval of any “related person transaction,” which is any transaction or series of transactions in which we or any of our subsidiaries is or are to be a participant, the amount involved exceeds $120,000 and a “related person” (as defined under SEC rules) has a direct or indirect material interest. Under the policy, a related person would need to promptly disclose to our Secretary any related person transaction and (i) all material facts about the transaction, (ii) the benefits to us of the related party transaction, (iii) if applicable, the availability of other sources of comparable products and services and (iv) an assessment of whether the proposed transaction is on terms that are comparable to the terms available to an unrelated third party or to employees generally. Our Secretary, together with outside legal counsel, would then assess whether the proposed transaction is a “related person transaction” and, if so, communicate that information to the Audit Committee. Based on its consideration of all of the relevant facts and circumstances, the Audit Committee will decide whether or not to approve such transaction. If we become aware of an existing related person transaction that has not been pre-approved under this policy, the transaction will be referred to the Audit Committee, which will evaluate all options available, including ratification, amendment or termination of such transaction. Our policy requires any member of the Audit Committee who may be interested in a related person transaction to recuse himself or herself from any consideration of such related person transaction.

COMPENSATION OF DIRECTORS

As compensation for serving on our Board of Directors in 2015, each of2017, our non-employee directors received a combination of cash retainer of $120,000 and stock having a value of $70,001, representing 8,906 shares of common stock.approximately $90,000. Our Chairman and Chief Executive Officer only receives compensation for his services as our Chief Executive Officer and President and receives no additional compensation for his service on our Board.Board of Directors. Our directors have been, and will continue to be, reimbursed by us for reasonable out-of-pocket expenses incurred in connection with their service on our Board of Directors and any and all committees.committees thereof.

The following table presents information relating to the total compensation of our directors for the fiscal year ended December 31, 2015.2017.

| Name | Fees Earned or Paid in Cash | Stock Awards and Fees Earned or Paid in Common Stock (1) | Total | Fees Earned or Paid in Cash | Stock Awards and Fees Earned or Paid in Common Stock (1) | Total | ||||||||||||||||||

| Douglas E. Neal | $ | 120,000 | $ | 70,001 | $ | 190,001 | ||||||||||||||||||

| David R. Bock | $ | 120,000 | $ | 70,001 | $ | 190,001 | $ | 120,000 | $ | 90,000 | $ | 210,000 | ||||||||||||

| Michael B. Clement | $ | 120,000 | $ | 90,000 | $ | 210,000 | ||||||||||||||||||

| Alan L. Hainey | $ | 120,000 | $ | 70,001 | $ | 190,001 | $ | 120,000 | $ | 90,000 | $ | 210,000 | ||||||||||||

| Steven G. Norcutt | $ | 120,000 | $ | 70,001 | $ | 190,001 | $ | 120,000 | $ | 90,000 | $ | 210,000 | ||||||||||||

| (1) | Represents the May |

Non-Employee Director Stock Ownership Guidelines

Our Board of Directors believes that significant ownership of our common stock by our directors helps to align the interests of our directors with those of our stockholders and is consistent with our commitment to sound corporate governance. Pursuant to our Director Stock Ownership Guidelines approved by our Board of Directors, non-employee directors are required to hold our common stock with a value equivalent to three times their annual cash retainer, or $360,000, and have from the later of five years from the adoption of the Director Stock Ownership Guidelines or the fifth anniversary of the date of the director’s commencement of service on our Board of Directors to comply. At any time that a director is not in compliance with these guidelines, such director will not be permitted to sell or dispose of any shares of our common stock except to the extent that such sale or disposal relates to payment of taxes associated with the vesting of restricted shares, or an award, of common stock. As of the date of this proxy statement, all non-employee directors have either exceeded their ownership requirement or remain within the five-year compliance period. For more information on the share ownership of our non-employee directors, see “Share Ownership of Certain Beneficial Owners and Our Directors and Executive Officers” herein.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under federal securities laws, our executive officers, directors and any persons beneficially owning more than ten percent (10%) of a registered class of our equity securities are required to report their ownership and any changes in that ownership to the SEC. These persons are also required by SEC rules and regulations to furnish us with copies of these reports. Precise due dates for these reports have been established, and we are required to report in this proxy statement any failure to timely file these reports by those due dates by our directors and executive officers during 2015.2017.

Based on our review of the reports and amendments to those reports furnished to us or written representations from our directors and executive officers that these reports were not required from those persons, we believe that all of these filing requirements were satisfied by our directors and executive officers during 2015.

EXECUTIVE OFFICERS

The following table and biographies contain information regarding our executive officers. These officers are appointed annually by our Board of Directors and serve at the Board’s discretion.

| Name | Age | Position | ||

| Steven R. Mumma | Chairman and Chief Executive Officer | |||

| Nathan R. Reese | ||||

| Kristine R. Nario | Chief Financial Officer | |||

For information on Mr. Mumma, please see his biographical description provided above under the caption “Proposal One:No. 1: Election of Directors — Directors—Nominees for Election as Directors.”